- EViews 8 introduces tools for estimating linear regression models that are subject to structural change. The regime breakpoints may be known and specified a priori, or they may be estimated using the Bai (1997), Bai and Perron (1998), and related techniques.

- Eviews 8 Free Download With Crack - lasopaimg. EViews (Econometric Views) is an sophisticated statistical deal, used primarily for statistical evaluation over time and statistical analysis. EViews provides a variety of equipment for forecasting, simulating, statistical and financial evaluation for students, academics, companies, government.

Eviews 8 Download

EViews 12 Demo for Windows 64-bit Only. Fill in the following form to request a demonstration copy of EViews 12 for Windows 64-bit. Once you have submitted the form, you will receive an email containing a serial number and download link for the demo copy within one business day. Please note that the demo copy of EViews 12 will expire in 30 days. This video covers how to input 3 types of data from Microsoft Excel to EViews 8: cross-section, time-series, and panel data. Subscribe for more videos. Free eviews 8.0 download software at UpdateStar - Supported Products:GeForce 500 series:GTX 590, GTX 580, GTX 570, GTX 560 Ti, GTX 560, GTX 550 Ti, GT 545, GT 530, GT 520, 510GeForce 400 series:GTX 480, GTX 470, GTX 465, GTX 460 v2, GTX 460 SE v2, GTX 460 SE, GTX 460, GTS 450, GT 440, GT.

Eviews 8 Download

- EViews 8.1 Enterprise Edition | 311.5 mb

- IHS Inc., the leading global source of information and analytics, has released EViews 8.1, an updated, more powerful version of its popular easy-to-learn, user-friendly Windows-based interface that enables quick and efficient development of statistical and forecasting models and simulations.

- EViews is used by corporate and financial economists, academic economists, market analysts and strategists, economic policy analysts, and government budget analysts and revenue forecasters. The system is used to access and analyze the latest economic data releases, build models and “what if” scenarios, conduct research and teach econometrics, and estimate the impact of new policies or major investment changes.

- EViews 8.1 adds a number of new features for our Enterprise users, offering new connectivity to a wider range of data sources, alongside the flexibility to write customized connections to even more.

- The following list of features are the incremental changes between EViews 8 and EViews 8.1:

- - New Messaging System

- EViews 8.1 introduces a messaging system that allows us to communicate news and important information to you on EViews startup. With this new system, you’ll never miss an important notification. The messages are designed to be non-intrusive, and you can adjust their frequency or opt out entirely. Messages include information such availability of new patches add-ins. You can configure these messages from Options->General Options->Environment->Startup.

- With EViews 8.1 Enterprise and an account with Bloomberg, you can seamlessly search, query, and retrieve data from the world's leading financial data source.

- EViews 8.1 Enterprise also allows direct access to data from the U.S. Energy Information Advisory (EIA), for free! EIA data includes many macro-economic variables, as well as hundreds of thousands of energy-sector specific series.

- EDX is a set of COM interfaces that allows users full flexibility to develop and implement a customized connection to bring data automatically into EViews from any public or proprietary data source.

- The EDO library allows you to work with data stored in EViews file formats outside of EViews simply by using existing Database Manager and Database objects already implemented by EViews. Learn more about EViews Enterprise to help you directly connect to all your data sources with the most recent data each time you open your workfile.

- IHS is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 6,000 people in 31 countries around the world.

- PLEASE SUPPORT ME BY CLICK ONE OF MY LINKS IF YOU WANT BUYING OR EXTENDING YOUR ACCOUNT THANK YOU!

- http://rapidgator.net/file/a0c8e8a8390912c0927e8690f31ab908/eEnEd81.rar.html

- http://ul.to/iy5la11r

The standard linear regression model assumes that the parameters of the model do not vary across observations. Despite this assumption. structural change, the changing of parameters at dates in the sample period, plays an empirically relevant role in applied time series analysis. Accordingly, there has been a large volume of work targeted at developing testing and estimation methodologies for regression models which allow for change.

EViews 8 introduces tools for estimating linear regression models that are subject to structural change. The regime breakpoints may be known and specified a priori, or they may be estimated using the Bai (1997), Bai and Perron (1998), and related techniques.

You may estimate “pure” breakpoint specifications in which all of the regressors have regime specific coefficients, or specifications in which only some coefficients vary with the regime.

Note that breakpoint regression is closely related to multiple breakpoint testing.

Breakpoint Example

To illustrate the use of these tools in practice, we employ the simple model of the U.S. expost real interest rate from Garcia and Perron (1996) that is used as an example by Bai and Perron (2003 “Computation and Analysis of Multiple Structural Change Models,” Journal of Applied Econometrics, 6, 72–78.). The data, which consist of observations for the three-month treasury rate deflated by the CPI for the period 1961q1–1983q3, are provided in the series RATES in the workfile realrate.wf1.

View a view of this Bai-Perron breakpoint example.

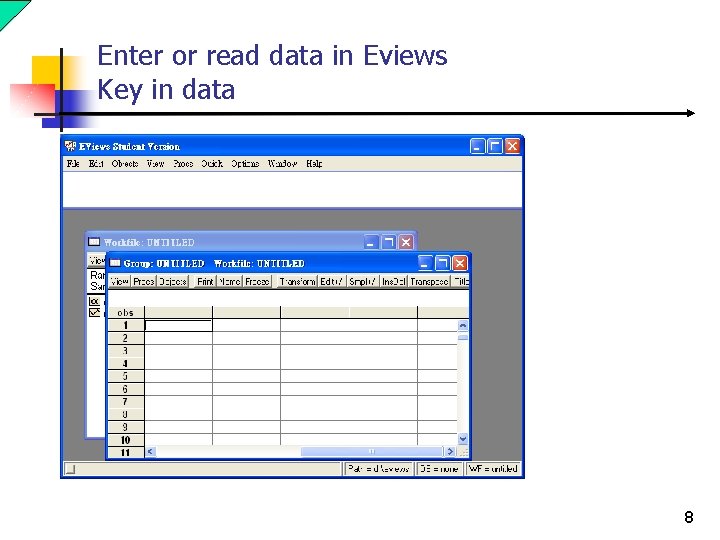

Select Object/New Object.../Equation or Quick/Estimate Equation… from the main menu or enter the command breakls in the command line and hit Enter.

The regression model consists of a regime-specific constant regressor so we enter the dependent variable RATES and C in the topmost edit field. The sample is set to the full workfile range.

Eviews 8 Serial Number

Next, click on the Options tab and specify HAC (Newey-West) standard errors, check Allow error distributions to differ across breaks, choose the Bai-Perron Global L breaks vs. none method using the Unweighted-Max F (UDMax) test to determine the number of breaks, and set a Trimming percentage of 15, and a Significance level of 0.05.

Lastly, to match the test example in Bai and Perron (2003), we click on the HAC Options button and set the options to use a Quadratic-Spectral kernel with Andrews automatic bandwidth and single pre-whitening lag:

Eviews 8 Crack

Click OK twice to accept the settings and estimate the model. EViews displays the results of the breakpoint selection and coefficient estimation:

The UDMax methodology selects a single statistically significant break at 1980Q4. The results clearly show a significant difference in the mean RATES prior to and after 1980Q4. Click on View/Actual, Fitted, Residual/Actual, Fitted, Residual Graph, to see in-sample fitted data alongside the original series and the residuals:

Casual inspection of the residuals suggests that the model might be improved with the addition of another breakpoint in the early 1970s. Click on the Estimate button, select the Options tab, and modify the Method to use the Global information criteria with LWZ criterion. Click on OK to re-estimate the equation using the new method.

EViews reports new estimates featuring two breaks(1972Q4, 1980Q4) defining a medium, low, and a high rate regime, respectively:

The corresponding actual, fitted, residual plot is given by: